GST changes from Saturday 1 July 2023

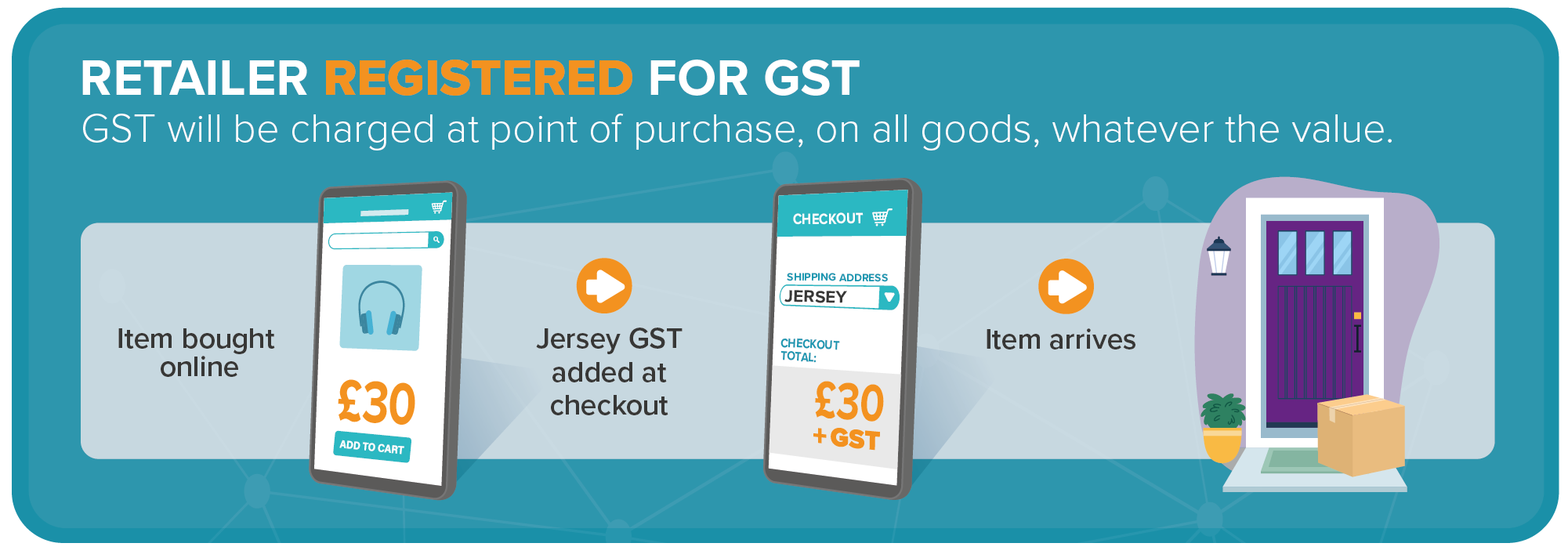

Online retailers that sell regularly to Jersey customers will be registered for GST and you'll pay GST at the point of purchase, regardless of the total value of your order.

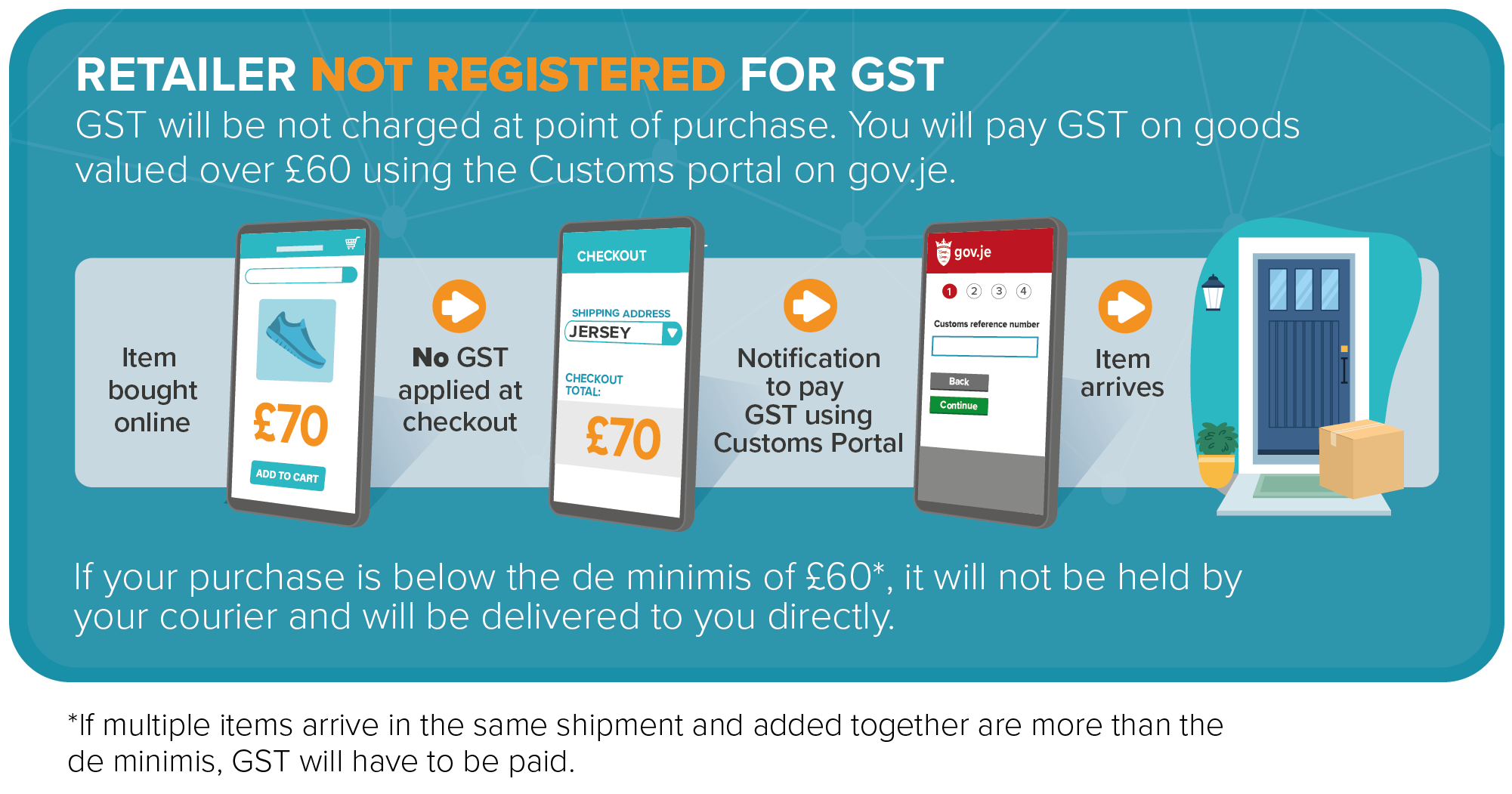

If the retailer is not registered you'll pay GST when the goods arrive in Jersey if they are more then the de minimis value.

The GST de minimis value has reduced to £60.

Changes to GST in Polish and Portuguese

Changes to GST in Polish

Changes to GST in Polish

Changes to GST in Portuguese

Changes to GST in Portuguese

Overseas retailer registered for GST

If you buy online, from a magazine or a brochure, the retailer will charge GST at the point of purchase. GST is added to the total cost including postage.

Goods are stopped but GST has been paid

If you get a message from Customs or your shipper to declare your goods but you have already paid GST at the point of purchase you do not pay GST again. Select the box on the online declaration page that GST has already been paid.

Returned goods and GST refunds

If you have to return your goods the retailer will deal with any refund including GST.

Overseas retailer not registered for GST

The retailer won't charge GST at the point of purchase and you will have to pay the GST on importation unless the total cost is below the

de minimis.

If you order multiple items and they arrive together in one shipment, we will treat this as a single delivery. You will be charged GST on the total value of the shipment.

If you have to return your goods, you will have to apply to Customs for a refund of the GST.

Declare and pay GST online

Customs or your shipper will send you a message that your goods are awaiting declaration so you can pay any GST and customs duties.

Pay for GST and customs duties

Once you have declared and paid, the shipping company will be notified and your goods will be released.

Customs do not hold your goods.

Correct a declaration or disclose an error to Customs

It is your responsibility to ensure all declarations made to Customs are true and accurate, to the best of your knowledge, at all times. In the event that additional information comes to light and you need to correct a declaration or disclose an error you have made after submitting your declaration, please email RGC@gov.je with the details. Our team will review the case and are able to revert the declaration to draft for you to make the necessary changes.

Returned goods and GST refunds

You can apply for a GST refund, or other customs duties, for goods you return to overseas retailers if it is returned within 3 months from the date of arrival in Jersey. You must wait until you have sent the item back to apply.

To apply for a GST refund you need:

- proof that the item has been returned. For example, postage confirmation

- the original invoice from when you bought the item

- refund confirmation from the retailer

You have 1 month to apply for a GST refund from the date the goods were returned.

You must make your refund application in writing by post or email to rgc@gov.je.

Relief from GST on returned goods: GST direction 2023/02

Types of customs duties

There are 3 types of customs duties in Jersey.

Goods and Services Tax (GST)

This is 5%, charged on the total value of your imported goods. The total value includes:

- the purchase price

- insurance

- commission

- packing and freight

- all taxes and duties applied before and on arrival, such as VAT, CCT and excise

Common Customs Tariff (CCT)

This is charged on all goods imported from outside the customs union. Find out how much you’ll need to pay on Trade Tariff: look up commodity codes, duty and VAT rates on GOV.UK

Specific items may be zero rated. Find more details on GST liability of goods and services.

Excise duty

You must pay excise duty regardless of where the goods come from or its total value. This is charged on alcohol, tobacco and fuel.

Excise duty rates

Alternative payment methods

Pay by bank transfers

Make sure you provide your invoice number in the payment reference.

Account name: Government of Jersey Customs or GOJ Customs

Bank: HSBC

Branch: St Helier, Jersey

Account Number: 21755072

Sort Code: 40-25-34

Pay by cheque

Make sure you provide your invoice number on the cheque as reference.

Make your cheque payable to the 'Treasurer of the States' and send it to:

Revenue and Goods Control

Customs and Immigration Service

Maritime House

La Route du Port Elizabeth

St Helier

Jersey

JE1 1JD

GST information for businesses

The de minimis does not apply to businesses. Businesses must always pay GST.

If your business trades goods within the customs union which includes the UK, Guernsey and the Isle of Man, see

customs approved traders.

If your business trades goods with countries outside the customs union, see

customs traders and agents.

GST for organisations

Paying GST if you are receiving or expecting goods

You can declare your goods before they arrive or when they have been received in Jersey.

You need to create an account on CAESAR to do this.

Log in or create a CAESAR account

Declaration Guide for goods imported from the customs union

Declaration Guide for goods imported from the customs union

Declaration Guide for goods imported outside the customs union (third countries)

Declaration Guide for goods imported outside the customs union (third countries)

Watch CAESAR declaration guide on YouTube.

Importing a vehicle and paying customs duties

If you import a vehicle to Jersey you need to pay 5% GST on the total value of the vehicle, including all freight charges and insurance costs.

You may also need to pay the Common Customs Tariff (CCT) if you import a vehicle from outside the customs union, which includes the UK, Guernsey and the Isle of Man. You can check the

Trade Tariff: look up commodity codes, duty and VAT rates on GOV.UK.

You’ll not be able to register the vehicle with Driver and Vehicle Standards (DVS) until you've paid the relevant duties and customs have cleared the vehicle. You may also need to pay

Vehicle Emissions Duty (VED). Find out more on

registering your vehicle in Jersey.

Temporarily importing goods

Some goods are exempt from customs duties if they’re in Jersey temporarily.

Relief from GST for imported goods

Appeal a decision from Jersey Customs

You can appeal our decision by emailing

rgc@gov.je. In your email provide details of the circumstances, supporting evidence and documentation.

You have one month from the date you receive the decision to appeal.

gov.je

gov.je