27 April 2018

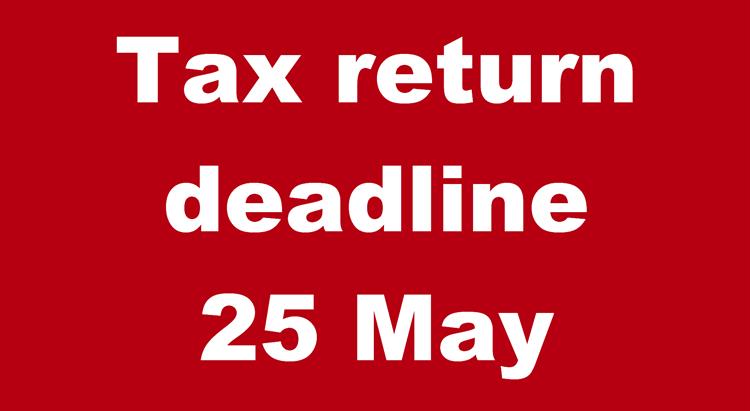

The Taxes Office is encouraging taxpayers to complete and file their personal tax returns before the bank holiday on 7 May 2018. There is now only one month remaining until the 25 May filing deadline, and around 40,000 of the 64,000 tax returns issued in 2017 have yet to be submitted.

Last year, the Taxes Office received more than a third of tax returns in the filing deadline week, while an average of around 4,000 taxpayers miss the deadline every year. The Taxes Office is therefore appealing to the public to file their tax returns during the next two weeks, in order to avoid unnecessary processing costs and, in the case of late-filers, the risk of a fine.

The current number of outstanding returns means that Islanders can still get a good place in the processing queue. Those getting a place within the first 30,000 tax returns submitted could receive an assessment by July, whereas people who wait until the last week may not receive their tax assessment until much later.

The Comptroller of Taxes, Richard Summersgill, explained the impact of these statistics “As anyone can imagine, physically receiving this volume of post in a week creates significant logistical issues. Aside from Jersey Post, there are very few, if any, local businesses that have to process such a volume of post.

“If taxpayers file close to the deadline, we will need to take on temporary staff to deal with the volume of returns received and for the subsequent return logging. Last-minute and late filing costs taxpayers money, because of the administration spike and, for those filing late, their £250 compulsory late-filing fee.”

To help taxpayers, the Taxes Office have created a ‘bite size checklist’ of more manageable steps available online. The site also has section-by-section instructions for the paper form and instructional videos. Alternatively, taxpayers can call the income tax helpline on 440300.

How to fill in your personal tax return