23 May 2019

Revenue Jersey is reminding taxpayers where to get help with their tax returns before next week’s filing deadline.

Personal tax returns must be filed with Revenue Jersey at Customer and Local Services, La Motte Street by 6pm on Friday, 31 May, and with less than two weeks to go, there are still more than 23,000 returns outstanding.

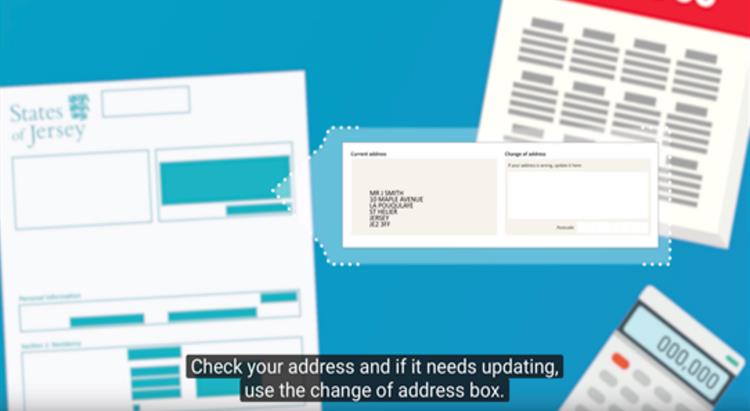

Islanders needing advice about how to fill in their returns should visit gov.je/mytaxreturn to access information and guidance videos. Videos and written guides cover each section of the tax return, and include information about:

- children

- pension contributions

- distributions from Jersey companies

- employment

- charitable giving

- mortgage interest relief

- property income; and

- income from renting out a room

The videos have subtitles available in English, Portuguese and Polish, and so far, they have had more than 107,000 views. The guides also include advice for taxpayers who are self-employed.

Paul Eastwood, Deputy Comptroller of Taxes, said: “This year, we have worked hard to make sure that our tax return guidance is as accessible as possible. The online guides and videos are easy to follow, and give taxpayers comprehensive advice and step by step support to help them complete their tax return.”

Mr Eastwood also reminded islanders that although Revenue Jersey staff can give information and advice, they are not allowed to fill in taxpayers’ returns for them.

He said: “Despite many people using our online guidance and help videos, we are still seeing a significant number of islanders bringing their paperwork to the tax help desk, and asking our staff to go through the form with them. While our staff are here to help, they are not allowed to decide or direct what information should go where. The tax return is a personal legal declaration, so taxpayers need to fill it in themselves.”

Anyone that needs help with their tax return should access the guidance information first. The Welcome Hosts at Customer and Local Services have been trained to signpost customers, who may not be confident internet users, to access the right advice using the CLS customer computers. Islanders can also access full printed guides at their local Parish Hall.

Mr Eastwood added: “Although it can seem complicated, most islanders are more than capable of filling in the return themselves if they follow the help and guidance available. For those that need additional help – such as taxpayers with additional needs through disability or a health condition – we have worked with a number of local charities, who are able to give support and advice.”

Islanders, particularly those with complex financial affairs, also have the choice of filing their return through a registered tax agent. Such agents have until 31 July to file the returns on their clients’ behalf.

Anyone wishing to file through a tax agent for the first time must let Revenue Jersey know in writing, before the 31 May deadline, to avoid a late filing penalty.