Tax calculator

Use our tax calculator to get an Independent Taxation illustration.

Tax calculator

Independent tax reform

Everyone will be independently taxed from 1 January 2026.

There will be a joint filing option for couples who are currently taxed as married or in a civil partnership.

The legal essentials

The law was approved by the States Assembly in February 2024. It removes the inequality between how co-habiting couples and married couples or civil partners are taxed.

- The legislation moves married couples and civil partners into Independent Taxation from 2026 if they are not already taxed independently.

- Each person will have a single person's allowance.

- Most couples will see no difference to the total tax they pay.

- If a couple, who were previously taxed under married or civil partnership taxation would pay more, they will receive a compensatory allowance.

- This will help couples where one partner's income is below the single person's allowance from seeing an immediate increase in their tax bill.

- The compensatory allowance will not increase, so that over the years, as the single person's allowance increases, the compensatory allowance will phase out until everyone is treated the same.

- If you don't want to file two separate returns, you will be able to request joint filing.

- When you complete a joint tax return, any compensatory allowance will be calculated automatically.

- Whether or not you choose joint filing, you will get your own tax assessment and be responsible for making your own payments.

How you may be affected

Most couples will pay the same tax as they do now when they move to Independent Taxation. Some will see changes to their tax bills. Some will pay more under Independent Taxation, so a compensatory allowance will be available.

The compensatory allowance

The compensatory allowance will be available to all couples who were married or in a civil partnership before 1 January 2022.

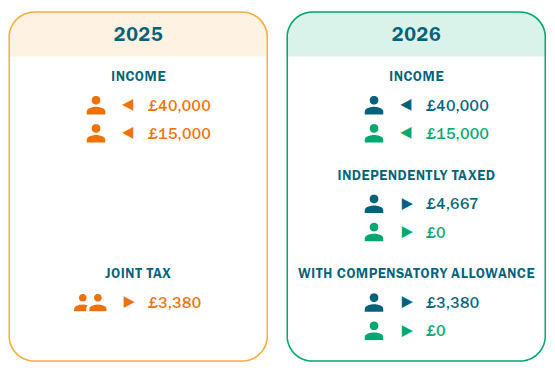

Here's an example of a couple who would receive the compensatory allowance as one spouse has income less than the single allowance.

Receiving the compensatory allowance

To receive the compensatory allowance, you will need to:

- fill out a joint tax return and the allowance will be calculated automatically if you need it

- if you fill out individual tax returns, we will need to receive both of them before we can calculate any compensatory allowance

You will only need the compensatory allowance if one spouse or civil partner's income is less than the single allowance in that year.

Changes in the amount of tax you each pay

Some couples in Independent Taxation will find they pay the same tax overall as a couple, but the share that each partner pays changes.

This is because you each pay your own tax based on your own income.

In these circumstances, if you're employed, your ITIS rate will go up or down.

Here's an example of a couple with two different salaries moving from a joint ITIS rate to their own ITIS rates.

Joint filing option

A joint filing option is available for couples who don't want to complete two returns or want to speed up the process for receiving the compensatory allowance.

How it works:

- Everyone who is not already being independently taxed, will be moved to Independent Taxation in 2026 and by default will file their own tax returns.

- Couples married or in a civil partnership before 2022 will have the option to file a joint tax return.

- This choice will need to made by both partners.

- The couple will nominate one partner to be responsible for filing the return and for any fines and penalties resulting from late filing.

- Once chosen, joint filing will continue each year unless either partner cancels it.

- The tax return will have sections to enter both partner's incomes.

- The compensatory allowance will be worked out automatically if it is due.

- Each partner will receive their own tax bill and be responsible for paying it.

Further information about Independent Taxation

When you complete your own tax return

You will complete your first Independent Taxation return in 2027 for the tax year 2026.

Declaring your income

You will declare your personal income, such as salary or pension, on your own tax return.

If your income is in joint names, for example savings or property income, you will both declare your share of the income and any expenses on your return.

If you receive a social security pension by virtue of your husband's contributions, you will declare it as your income under Independent Taxation.

Claiming deductions

You will claim expenses that you pay personally, like work expenses or contributions into a pension scheme, on your own tax return.

Shared allowances

Any available child allowance will be shared between you equally unless you tell us otherwise.

Tax filing help

If you've not completed a tax return before or it's been a while since you last completed one, help is available to register for online filing and there are guides to help you complete a paper return.

File your personal tax return

Paying your own tax

Income Tax Instalment Scheme (ITIS)

You'll receive your own ITIS rate if you're employed. It will be calculated based on, and pay towards, your individual tax bill.

Payment on account

If you are liable to pay tax but have little or no employment income, you'll will be asked to make two payments on account in November and the following May.

If you want to spread these payments over the year you can set up a direct debit.

Direct debits

Direct debits are normally reviewed annually according to changes in your tax bill.

If you have a direct debit that covers all your joint tax or your part of the joint tax, you may want to review the amount when you are independently taxed.

You may need to set up a new direct debit on your own account to pay your own tax.

Direct debit information

Other payments

When you pay with a card online or send a payment using online banking, make sure you quote your own individual tax identification number (TIN).

Pay your personal or company tax

Repayments of tax

Any overpayments made before you're independently taxed will go to the primary taxpayer unless we are instructed otherwise.

Under Independent Taxation any repayments will go to you.

Paying off old tax

Tax debt

Paying the tax on income in any year before you move to Independent Taxation, will always remain the responsibility of the primary taxpayer in the marriage or civil partnership. This will still be the case even after you move to Independent Taxation.

Most couples decide together how they pay any arrears, in the same way they deal with other common liabilities that are legally in one partner's name.

Any previous payment agreements would remain in force.

Problems paying your personal tax

Prior year basis 'PYB' tax

The 2019 frozen tax is the responsibility of the primary taxpayer in the marriage or civil partnership. This stays the case even after you move to Independent Taxation.

Most couples will decide together which option they choose to pay the liability, in the same way they deal with other common liabilities that are legally in one partner's name.

Prior year basis tax reform

Getting married or separating

You'll still need to let us know if you get married or permanently separate from your spouse or civil partner.

If you separate you'll be taxed as a single person.

Tell Revenue Jersey you're married or in a civil partnership

High value residents

Independent Taxation applies to all married couples and civil partners in Jersey, including high value residents (HVRs). New HVR's arriving in Jersey from 2022 onwards will be subject to Independent Taxation rules. Any HVR couples who separate from 2022 would also fall into the new Independent Taxation regime.

Non-residents

Independent taxation also applies to non-resident married couples and civil partners.

If you register for tax or get married from 2022 you'll be independently taxed and you won't be able to use the married couples exemption threshold in your non-resident relief claim.

When independent taxation becomes compulsory if you are both in receipt of Jersey income, for example from a jointly owned property, you'll both need to file a non-resident tax return.

Non-resident tax relief

Data privacy

Spouse or civil partner's permission

If you currently have permission to discuss your spouse's or partner's tax (the primary taxpayer), this will be automatically cancelled once you move to Independent Taxation.

Joint access to information from 2021

The law was changed from the year of assessment 2021, so that information can be provided to both spouses or civil partner's while they are being taxed under married or civil partnership tax law. This will not apply when you move to Independent Taxation.

Tax agents' authority

When you are independently taxed, you'll make all the choices about how you manage your own tax affairs.

You may wish to appoint a qualified tax professional (tax agent) to deal with your tax affairs, especially if you have more complex tax circumstances.

There is no obligation to have a tax agent because your spouse or partner does, or to appoint the same tax agent.

If you decide to have a tax agent to deal with your tax when you are independently taxed, they will ask you to sign an 'all communications' authority. This will allow the tax agent to communicate directly with us about your tax affairs.

If you currently have a tax agent looking after your tax as a couple, the current 'all communications' authority will continue to apply to the

primary taxpayer only.