How to tell us

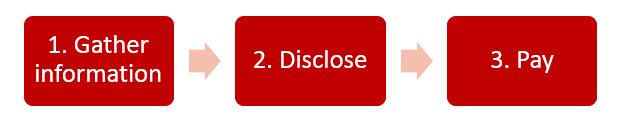

There are 3 simple steps you need to take:

- Gather information: you might need to access historic information such as bank records or accounts.

- Disclose: use the online form. Voluntary disclosure form

- Pay: once you've made your disclosure, we'll review your information, tell you how much you owe and how to pay.

Reasons you might need to make a voluntary disclosure

You should make a disclosure if you have:

- submitted returns that don't include all your income

- submitted returns that are incorrect such as understating your income, or claiming an allowance you're not entitled to

- not submitted returns at all

Returns can include:

- annual tax returns for people or businesses

- GST returns

- monthly employer ITIS returns

- other statements or documents that you have provided to Revenue Jersey in support of a tax return

Types of income you may need to tell us about

We will take into account that you made a voluntary disclosure when we calculate any settlement figure.

Disclosure help and advice

If you need any help call the tax disclosure helpline.